airjordan4.site

Learn

Professional Trader Strategy

What Can We Learn From Professional Trading Strategies? · 1. Focus · 2. Learn the Dynamics of Your Markets · 3. Manage Your Emotions · 4. Know When to Be. Little-known trade secrets and powerful strategies to level the playing field and help you turn profitable! Page 3. The 7 Best-Kept Secrets of Professional. Day trading is not a secret or a special skill. It is easy, but you need to focus, be consistent, and manage your risk well. Pick a plan. A systematic approach will help you choose the exact trade strategy in Forex that will work for you and increase the efficiency of Forex trading. That is why. Skill #3 – Adapting Your Market Analysis to Changing Market Conditions Over time, master traders develop strategies and trading techniques that they use over. FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $, How. Find out 8 trading strategies every trader should know: Swing Trading, Position Trading, Day Trading, Price Action Trading, Algorithmic Trading, and News. Skill #3 – Adapting Your Market Analysis to Changing Market Conditions Over time, master traders develop strategies and trading techniques that they use over. A professional trader is defined by how he approaches his trading mentally and how he manages his trading routine day to day. Therefore, every amateur trader. What Can We Learn From Professional Trading Strategies? · 1. Focus · 2. Learn the Dynamics of Your Markets · 3. Manage Your Emotions · 4. Know When to Be. Little-known trade secrets and powerful strategies to level the playing field and help you turn profitable! Page 3. The 7 Best-Kept Secrets of Professional. Day trading is not a secret or a special skill. It is easy, but you need to focus, be consistent, and manage your risk well. Pick a plan. A systematic approach will help you choose the exact trade strategy in Forex that will work for you and increase the efficiency of Forex trading. That is why. Skill #3 – Adapting Your Market Analysis to Changing Market Conditions Over time, master traders develop strategies and trading techniques that they use over. FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $, How. Find out 8 trading strategies every trader should know: Swing Trading, Position Trading, Day Trading, Price Action Trading, Algorithmic Trading, and News. Skill #3 – Adapting Your Market Analysis to Changing Market Conditions Over time, master traders develop strategies and trading techniques that they use over. A professional trader is defined by how he approaches his trading mentally and how he manages his trading routine day to day. Therefore, every amateur trader.

Trading is a competition between two sides where there is always a winner and a loser. The Core Strategy course may help keep you on the winning side. The use of trading strategies in investments is meant to ensure consistent results and evade behavioral financial biases. Traders can decide to use either. Many people have the aspiration of becoming professional traders, but achieving this objective calls for commitment, self-control. Traders should constantly be reevaluating their own trading strategies and formulating new ones. After reading this article you will understand how professional. Professional traders use a variety of strategies, but common ones include trend following, day trading, swing trading, and algorithmic trading. Profitable trading strategies. A professional trader will have profitable trading strategies in order to make money in the markets. · Disciplined trading. Key characteristics of a professional forex trader also include being realistic. They know they won't generate a salary in the millions if they have a few. The first step into creating your own trading strategy is to determine what type of trader you are, your time frame of trading, and what products you will trade. Mastering the Art of Trading: A Guide to Becoming a Pro Trader · Educate Yourself · Choose Your Market and Trading Style · Develop a Trading. Due to the fact that professional traders have mastered their forex trading strategy, they trade less frequently than amateur traders because the pros are. Traders should constantly be reevaluating their own trading strategies and formulating new ones. After reading this article you will understand how professional. How to become a professional trader · 1. Learn the trading basics · 2. Learn the advanced basics · 3. Develop trading systems and techniques · 4. Gain trading. Mastering the Art of Trading: A Guide to Becoming a Pro Trader · Educate Yourself · Choose Your Market and Trading Style · Develop a Trading. Based on their market research and analysis, professional traders develop trading strategies that align with their investment goals and risk tolerance. They may. Real Pro Strategies From Real Pro Traders · Start Scanning For Top Stocks Now · Stock Strategies · Surging Stock Scanner · Futures Strategies · Forex. With day trading, it all comes down to risk mitigation, having a simple strategy and world class discipline. Do you consider yourself a determined person? When. Day trading refers to a trading strategy where an individual buys and sells Financial Professional Gateway (FinPro) · Financial Industry Networking. Many professional traders develop their own trading strategies by trader finds a viable strategy that produces profits consistently. strategic thinking to start a career as a trader. Investing in stocks, forex trading tools, and a range of strategies used by professional traders. airjordan4.site: Trading Strategies: 6 Books in 1 - The Most Efficient Guide About How to Become a Professional Trader With Forex Trading, Options Trading.

Can I Have 2 Current Accounts

8 reasons to have more than one current account · If your bank has technical issues · To separate your savings or overdraft · To manage your money with someone. You can usually use the same bank account on two different PayPal accounts. Learn more about how to link a bank account. Was this article helpful? Yes. Depending on the bank in question and the type of accounts, you can open more than one current account with the same bank. For example, you'll often find you. A joint checking account allows two or more people, often spouses, to write checks and make deposits. The ownership of a joint account may depend on the. Accounts can be opened in person at a branch office or online, depending on the bank you choose. If you plan to do it in person, both account holders will need. Unfortunately, we don't offer joint accounts at this time. If you're the parent of a teenager, you can open an account for your teen so they can have their own. It's per account titling. So you can have multiple accounts at a bank under different titling and receive more than the $, Leave your. 5 crore, the borrower can have a Current Account with only one bank with which it has CC/OD facility. Also, the bank must have at least 10% of the banking. A joint account is a chequing or savings account that is in the name of two or more people (at TD, you can add up to 9 people on a joint account). The account. 8 reasons to have more than one current account · If your bank has technical issues · To separate your savings or overdraft · To manage your money with someone. You can usually use the same bank account on two different PayPal accounts. Learn more about how to link a bank account. Was this article helpful? Yes. Depending on the bank in question and the type of accounts, you can open more than one current account with the same bank. For example, you'll often find you. A joint checking account allows two or more people, often spouses, to write checks and make deposits. The ownership of a joint account may depend on the. Accounts can be opened in person at a branch office or online, depending on the bank you choose. If you plan to do it in person, both account holders will need. Unfortunately, we don't offer joint accounts at this time. If you're the parent of a teenager, you can open an account for your teen so they can have their own. It's per account titling. So you can have multiple accounts at a bank under different titling and receive more than the $, Leave your. 5 crore, the borrower can have a Current Account with only one bank with which it has CC/OD facility. Also, the bank must have at least 10% of the banking. A joint account is a chequing or savings account that is in the name of two or more people (at TD, you can add up to 9 people on a joint account). The account.

Can I have more than one current account? Team Kroo. Updated 2 years ago. Currently, you can open one current account per person. A joint current account is a type of bank account you share with someone else. This could be a housemate, partner, spouse or family member. You'll have equal. You can have up to 20 accounts open with us at once, with a maximum of 10 saver accounts. Each account will have its own unique account number. However, with Relay Financial the process of creating a new account can be accomplished in a matter of minutes, and in fact you can have up to 20 separate. Yes, You can have two accounts in a bank: In two different branches or at the same branch. You will have to let them know the purpose of second. Keeping your money in multiple accounts at different banks can be even more beneficial. That's because there are usually longer processing times for inter-bank. The two main types of bank accounts are current accounts and deposit accounts. If you do not have a bank account, you can open a basic bank account. A. One of the biggest challenges of having multiple bank accounts is keeping track of all the information. You may have to log into different websites, apps, or. There is usually no limit to the number of providers you can have a current account with. However, there may be a limit to the number of accounts you can have. While there's no limit to how many Savings Accounts you can have, there are a few things to consider before signing up for more than one. According to financial. Go to settings, go to Wallet and Apple Pay, press “Apple Cash” then scroll a little and press “Bank Account”. Then you can proceed with what you are wanting to. There's no limit to the number of current accounts you can have. For example, you may have your main current account for bills, and a separate current account. Yes, you can apply for more than one account on the same day. At the end of an online application you will be given the option to apply for more products. Opening a secondary savings account is a good idea if you have a specific financial goal you're saving for. Kayikchyan recommends having two savings accounts—. Do you have one of these accounts with us? 1|2|3 Current Account. 1|2|3 Lite Current Account. Three bank accounts is not necessarily too many, though it depends on a person's situation. Having a checking account, a savings account for a down payment on a. There isn't a limit on the number of bank accounts your business can have. In theory, you could open as many as you want, as long as your bank approves each. You can usually use the same bank account on two different PayPal accounts. Learn more about how to link a bank account. Was this article helpful? Yes. You're free to have multiple business accounts, provided they align with your business needs and your business is equipped to handle these. One simple and effective technique is to set up three different bank accounts. Each has a separate purpose and it allows you to effectively manage your money.

Domestic Wire Transfer Service

Webster Bank's Domestic Wire Transfer Online Services are an effective tool for sending money when speed and certainty are paramount. Get Started Now. Sending domestic wires through Personal Online Banking is secure and convenient. Certain limitations on eligibility apply. Fees. Your account will be assessed a. Private Bank Online's self-serve domestic wire transfer feature offers a simple and secure way to quickly send funds from an eligible Private Bank Investment. Banks and non-bank money wire providers can charge fees to send and receive wire transfers. Typically, international wire transfer fees are higher than domestic. A wire transfer is a method of transmitting money electronically between people or businesses in which no physical money is exchanged. To send a wire transfer, you need to visit your local branch and provide the following information about the recipient's account: Account holder name and full. Domestic wires transmit funds to a recipient located in the same country as the sender. Depending on your bank, you may be able to initiate a domestic transfer. You can use our incoming and outgoing money transfer services to wire funds to any financial institution in Canada, the US, and most countries overseas. This guided demo will focus on wire transfers sent to domestic recipients in Online Banking. For more information, visit our Wire Transfers page. Webster Bank's Domestic Wire Transfer Online Services are an effective tool for sending money when speed and certainty are paramount. Get Started Now. Sending domestic wires through Personal Online Banking is secure and convenient. Certain limitations on eligibility apply. Fees. Your account will be assessed a. Private Bank Online's self-serve domestic wire transfer feature offers a simple and secure way to quickly send funds from an eligible Private Bank Investment. Banks and non-bank money wire providers can charge fees to send and receive wire transfers. Typically, international wire transfer fees are higher than domestic. A wire transfer is a method of transmitting money electronically between people or businesses in which no physical money is exchanged. To send a wire transfer, you need to visit your local branch and provide the following information about the recipient's account: Account holder name and full. Domestic wires transmit funds to a recipient located in the same country as the sender. Depending on your bank, you may be able to initiate a domestic transfer. You can use our incoming and outgoing money transfer services to wire funds to any financial institution in Canada, the US, and most countries overseas. This guided demo will focus on wire transfers sent to domestic recipients in Online Banking. For more information, visit our Wire Transfers page.

Before you visit a branch to make your wire transfer, please review the following forms to make sure you're prepared with all required info: Domestic. Wire transfers are a quick way to send money domestically or internationally. While you can do both in Mobile Banking and Online Banking, this guided demo. Wire transfers are one of the most effective and prompt ways to move money electronically from one business to another. Our Online Domestic Wire Services. Wire Transfer Fees ; Outgoing, Domestic, $, pm CST ; International (USD), $* ; International (Foreign Currency), $*. A wire transfer is an electronic transfer of funds via a network that is administered by banks and transfer service agencies around the world. Domestic wire transfers are often processed within 24 hours while international wire transfers can take between business days. Wire transfer times may also. Efficiently transfer funds within the country at affordable costs. Ensure that your wire transfers are processed within 24 hours to manage immediate payments. Wire transfers are commonly done through two methods: bank transfers and wire transfer services. Keep in mind that wire transfers are typically subject to fees. A wire transfer is one method individuals and businesses use to move money. It involves a direct electronic transfer of funds from an account at one. Need to send or receive money quickly and easily? Associated Bank offers secure wire transfer services to our business customers. Use domestic wire. A wire transfer is an electronic method of moving money between two banks or credit unions. They can be either domestic or international. Other money-transferring services limit how much money you can transmit, but wire transfers allow you to send more than $10, Wire transfers deliver funds to. If you wish to receive a wire transfer, you will need to provide your wiring instructions. You can download the form on the Wire Transfers – Personal Banking. Wire transfer, bank transfer, or credit transfer, is a method of electronic funds transfer from one person or entity to another. A wire transfer can be made. Send domestic and international wires to personal or business accounts quickly and securely with Wells Fargo Online® Wires. Now, you can also send money to US bank accounts from the USA and beyond. Save your friends and family time when you send online wire transfer directly to their. Originate wire transfers in a secure & timely manner · Immediate transmission of available funds bank to bank · Same day and final settlement for domestic wire. US domestic wires run through Fedwire, an electronic funds-transfer service run by the Federal Reserve Board, and CHIPS, Fedwire's private sector counterpart. A bank teller can help you set up many other transfer services, including wire transfers to another bank, state, or country. If you're looking to transfer funds. A wire transfer is a safe way to send or receive money from around the world. You can send wires in almost any currency and receive them in either Canadian.

Paying Extra Principal Calculator

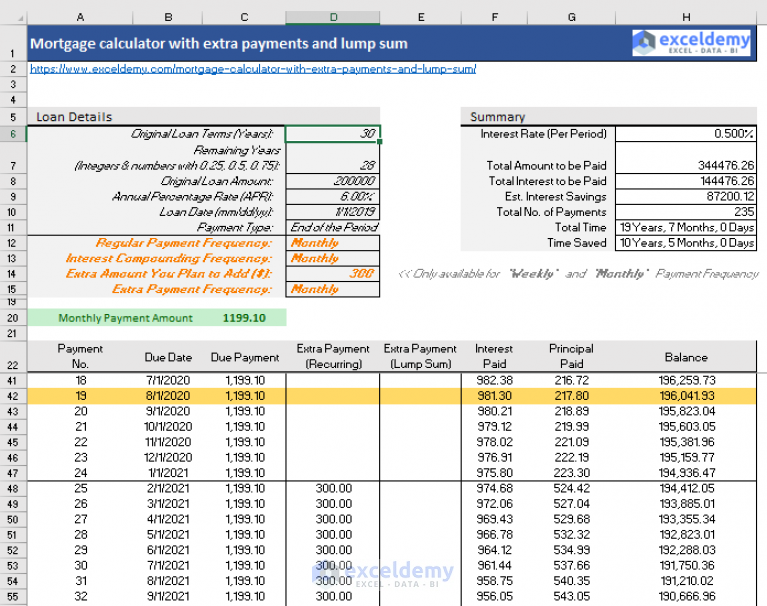

Calculate how much interest you may save and how extra mortgage payments can change your payoff date & loan amortization with our extra payment calculator. We want to lend a hand in any way we can. If you're curious about the benefits of adding an additional principal amount to your monthly payment, we encourage. This calculator allows you to enter an initial lump-sum extra payment along with extra monthly payments which coincide with your regular monthly payments. extra monthly payment every year and will shorten your amortization. Some The first regular monthly principal and interest payment is due one month after the. Find out how much interest you can save by paying an additional amount with your mortgage payment. The additional amount will reduce the principal on your. Use this loan repayment calculator to work out monthly repayment and interest figures for personal loans, student loans or any other type of credit agreement. Use this calculator to see how making extra payments affects how soon you can pay off your mortgage and how much interest you pay on your home loan. Enter your loan info and desired payment amount into our extra payments calculator Footnote(Opens Overlay) to see if it makes sense for you to add extra. This amortization calculator shows the schedule of paying extra principal on your mortgage over time. See how extra payments break down over your loan term. Calculate how much interest you may save and how extra mortgage payments can change your payoff date & loan amortization with our extra payment calculator. We want to lend a hand in any way we can. If you're curious about the benefits of adding an additional principal amount to your monthly payment, we encourage. This calculator allows you to enter an initial lump-sum extra payment along with extra monthly payments which coincide with your regular monthly payments. extra monthly payment every year and will shorten your amortization. Some The first regular monthly principal and interest payment is due one month after the. Find out how much interest you can save by paying an additional amount with your mortgage payment. The additional amount will reduce the principal on your. Use this loan repayment calculator to work out monthly repayment and interest figures for personal loans, student loans or any other type of credit agreement. Use this calculator to see how making extra payments affects how soon you can pay off your mortgage and how much interest you pay on your home loan. Enter your loan info and desired payment amount into our extra payments calculator Footnote(Opens Overlay) to see if it makes sense for you to add extra. This amortization calculator shows the schedule of paying extra principal on your mortgage over time. See how extra payments break down over your loan term.

By making a small additional monthly payment toward principal, you can Use our extra payment calculator to determine how much more quickly you may. PNC's mortgage calculator with extra payments estimates how much you could save by making additional payments and what the amortization schedule would be. Use the mortgage with extra payments calculator to learn how paying extra on a mortgage affects your interest cost and repayment term. Biweekly Extra Principal Calculator. Are you interested in paying off your loan even sooner with additional payments to your biweekly payment amount? We will. Use our free mortgage calculator to easily estimate your monthly payment. See which type of mortgage is right for you and how much house you can afford. Calculate the extra payments needed to pay off your home loan by a certain date with this specialized calculator from GMFS Mortgage. Next steps in paying off your mortgage. If you want to accelerate the payoff process, you can make biweekly mortgage payments or put extra sums toward principal. Monthly Payment Loan Calculator w/Extra Payments. Enter the three (3) known fields, then press the button next to the field to calculate. Calculators. Calculators Overview · Mortgage Payment Calculator · Home Value extra $1, each year going directly to paying off your mortgage principal. Use the RBC Royal Bank mortgage payment calculator to see how mortgage amount, interest rate, and other factors can affect your payment. Easily calculate your savings and payoff date by making extra mortgage payments. Learn the benefits and disadvantages of paying off your mortgage faster. Extra monthly payments help pay off your mortgage faster. Use our extra payment calculator to determine how much more quickly you may be able to pay off. extra principal payments in addition to your biweekly payment. This Mortgage Payoff Calculator: How much extra payment should I make each month to pay. Additional payment. See how much you could save on your total bond costs by paying extra into your home loan. Current. In addition to saving interest payment, you'll also repay the loan sooner, freeing up extra cash at the end. Disclaimer: The accuracy of these calculators and. We want to lend a hand in any way we can. If you're curious about the benefits of adding an additional principal amount to your monthly payment, we encourage. (principal) that they are obligated to pay back in the future. Loans Simply add the extra into the "Monthly Pay" section of the calculator. It is. By paying extra toward your principal each month, you stand to greatly accelerate the term of the loan and could save a bunch of money on interest. To see. By paying extra toward your principal each month, you stand to greatly accelerate the term of the loan and could save a bunch of money on interest. To see how. This calculator determines your mortgage payment and provides you with a mortgage payment payments a year, the equivalent of one extra monthly payment a year.

Equity In Balance Sheet

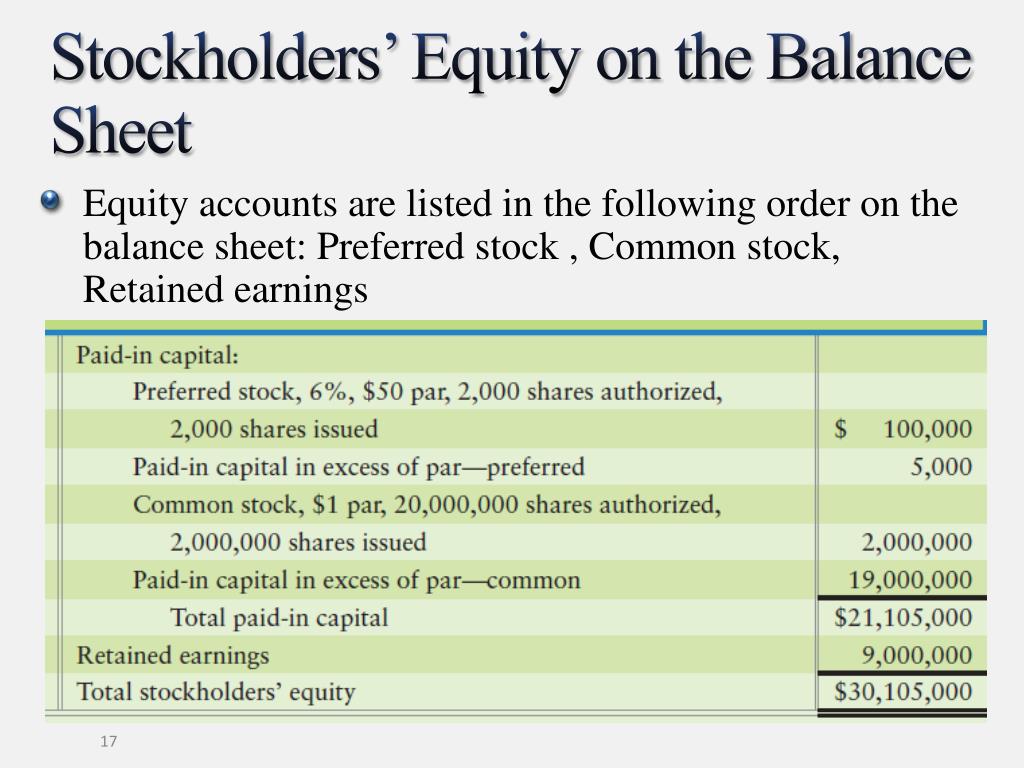

Stockholders Equity (also known as Shareholders Equity) is an account on a company's balance sheet that consists of share capital plus retained earnings. Shareholders Equity = Total Assets – Total Liabilities It is the basic accounting formula and is calculated by adding the company's long-term as well as. Equity in accounting is the remaining value of an owner's interest in a company after subtracting all liabilities from total assets. A balance sheet is a financial document that shows the assets, liabilities and equity of a company as at a specific reporting date. In other words, total equity is calculated by subtracting the total liabilities from the business's total assets (this is just rearranging the basic accounting. Theoretically, the Equity section of the Balance Sheet represents the owners portion of the business after all the Liabilities have been paid off. Technical. Equity is considered a type of liability, as it represents funds owed by the business to the shareholders/owners. On the balance sheet, Equity = Total Assets –. A standard company balance sheet has two sides: assets on the left, and financing on the right–which itself has two parts; liabilities and ownership equity. The. Equity is the amount of money that a company's owner has put into it or owns. On a company's balance sheet, the difference between its liabilities and assets. Stockholders Equity (also known as Shareholders Equity) is an account on a company's balance sheet that consists of share capital plus retained earnings. Shareholders Equity = Total Assets – Total Liabilities It is the basic accounting formula and is calculated by adding the company's long-term as well as. Equity in accounting is the remaining value of an owner's interest in a company after subtracting all liabilities from total assets. A balance sheet is a financial document that shows the assets, liabilities and equity of a company as at a specific reporting date. In other words, total equity is calculated by subtracting the total liabilities from the business's total assets (this is just rearranging the basic accounting. Theoretically, the Equity section of the Balance Sheet represents the owners portion of the business after all the Liabilities have been paid off. Technical. Equity is considered a type of liability, as it represents funds owed by the business to the shareholders/owners. On the balance sheet, Equity = Total Assets –. A standard company balance sheet has two sides: assets on the left, and financing on the right–which itself has two parts; liabilities and ownership equity. The. Equity is the amount of money that a company's owner has put into it or owns. On a company's balance sheet, the difference between its liabilities and assets.

The Balance Sheet: Stockholders' Equity. Preferred stock, common stock, additional paid‐in‐capital, retained earnings, and treasury stock are all reported on. The owner's equity statement is one of four key financial statements and is usually the second statement to be generated after a company's income statement. In accounting, the Statement of Owner's Equity shows all components of a company's funding outside its liabilities and how they change over a specific. Stockholders' Equity (also known as Shareholders Equity) is an account on a company's balance sheet that consists of capital plus retained earnings. Total liabilities and owners' equity are totaled at the bottom of the right side of the balance sheet. Remember —the left side of your balance sheet (assets). In cases where the balance sheet includes personal assets and liabilities, the resulting equity from personal items is also included in the valuation equity. It appears on a company's balance sheet, along with assets and liabilities. What is the difference between equity and shareholders' equity? There is no. This same identity is also expressed in another way: total assets minus total liabilities equals total owners' equity. In this form, the equation emphasizes. There are five critical entries on a balance sheet related to equity: retained earnings, common stock, preferred stock, treasury stock, and other comprehensive. Owners' equity goes by many names, including shareholders' equity and stockholders' equity. The owners' equity line items listed in some companies' balance. How do you calculate equity on a balance sheet? · Total all assets. · Total all liabilities. · Subtract total liabilities from total assets. When the balance sheet is not available, the shareholder's equity can be calculated by summarizing the total amount of all assets and subtracting the total. Equity. Equity represents the amount of net money owners have invested into their business, including earnings they have gained after distributing payments to. Assets, liabilities and equity are the three sections of every business's accounting balance sheet. Assets are things your business owns. If the company is a corporation, the third section of a corporation's balance sheet is Stockholders' Equity. (If the company is a sole proprietorship, it is. Equity, or owner's equity, is generally what is meant by the term “book value,” which is not the same thing as a company's market value. Equity accounts. A balance sheet is a document that details a company's assets, liabilities, and, subsequently, the owner's equity at a specific point in time. The owner's. The stockholder's equity section of the balance sheet contains basically four items: • Par value of issued stock. • Paid-in capital in excess of par. • Retained. A balance sheet summarizes a company's assets, liabilities and shareholders' equity at a specific point in time.

How Much Money To Donate Blood Plasma

Platelet & Plasma Donations ; Double Platelet/Plasma, 75 ; Double Platelet, 50 ; Platelet/Plasma, 50 ; Platelet/Red Cell, As of , I've donated 39 times since and made $2, which averages to $ each visit. The donation itself takes about Donors are compensated starting at $ The collection involves the insertion of a needle into one arm and blood is removed from one arm into a collection bag. How much blood do you give when you donate? ml. It's about 8% of the average adult's blood volume. Within hours of donating, your body will have. Find the hours & address for the Octapharma Plasma Donation Center in Garden Grove, CA, off Katella Ave - Donate Plasma. Make Money. Save Lives. NBNU strongly opposes the licensing of for-profit clinics that pay clients to donate blood plasma. We believe these clinics pose a serious safety risk to our. PSG pays qualified donors a minimum of $ per plasma donation. A great need exists for human plasma rich in specialty antibodies to manufacture diagnostic. They will pay you anywhere from $20 a unit up to $ a unit. You can donate whole blood at any blood donation center and you will not be. Because the blood is processed and returned to the donor it takes longer to donate plasma than to donate whole blood. how far individuals travel to donate. Platelet & Plasma Donations ; Double Platelet/Plasma, 75 ; Double Platelet, 50 ; Platelet/Plasma, 50 ; Platelet/Red Cell, As of , I've donated 39 times since and made $2, which averages to $ each visit. The donation itself takes about Donors are compensated starting at $ The collection involves the insertion of a needle into one arm and blood is removed from one arm into a collection bag. How much blood do you give when you donate? ml. It's about 8% of the average adult's blood volume. Within hours of donating, your body will have. Find the hours & address for the Octapharma Plasma Donation Center in Garden Grove, CA, off Katella Ave - Donate Plasma. Make Money. Save Lives. NBNU strongly opposes the licensing of for-profit clinics that pay clients to donate blood plasma. We believe these clinics pose a serious safety risk to our. PSG pays qualified donors a minimum of $ per plasma donation. A great need exists for human plasma rich in specialty antibodies to manufacture diagnostic. They will pay you anywhere from $20 a unit up to $ a unit. You can donate whole blood at any blood donation center and you will not be. Because the blood is processed and returned to the donor it takes longer to donate plasma than to donate whole blood. how far individuals travel to donate.

New plasma donors can earn over $ during the first 35 days! In addition to getting paid for each plasma donation, you can make even more money during. Paying for blood donations is not in question. It is important to distinguish plasma donation from blood donation, something many who have weighed in on this. Plasma donations in Everett WA. Allergic & autoimmune donors needed. Apply today to be screened for program. Eligible donors earn up to $ per donation. Who can donate? Generally, plasma donors must be 18 years of age and weigh at least pounds (50kg). All individuals must pass two separate medical. After each successful donation, you will be paid between $$60 in NYC and between $$ in Florida. We hope to see you soon! Ways to Give. "Icon. Our healthcare systems rely heavily on communities to generously donate blood. However, there are many reasons why a. Canadian Blood Services has previously cautioned that letting companies trade cash for plasma - a practice banned in British Columbia, Ontario and Quebec -. A plasma donation allows you to give a specific part of your blood and help patients with life-threatening blood loss. Donate plasma today! Donated blood helps meet many medical needs, including those of people who Blood contains several components, including red cells, platelets and plasma. Platelet & Plasma Donations ; Double Platelet/Plasma, 75 ; Double Platelet, 50 ; Platelet/Plasma, 50 ; Platelet/Red Cell, You can safely donate plasma every 28 days, 13 times per year. AB donors can safely give three times the amount of plasma as can be separated from a whole blood. Learn how to donate plasma for the first time. Find more about CSL's donor-focused plasma donation process, qualifications, and how to get compensated. What is plasma and why is it important? Plasma serves many important functions in our body. Learn more about plasma and its importance. Because the blood is processed and returned to the donor it takes longer to donate plasma than to donate whole blood. how far individuals travel to donate. You cannot give plasma if you weigh less than 50 kg ( lb), regardless of your height. You can use the calculator below as a guideline to verify your. Giving blood is a simple thing to do, but it can make a big difference in the lives of others. Make a blood donation appointment with the American Red Cross. much money at feel good movements with no accountability to generate tangible results. So until the system is fixed, I would rather give. Giving blood is a simple thing to do, but it can make a big difference in the lives of others. Make a blood donation appointment with the American Red Cross. From what I remember, the first 5 times you donate it's $60 a pop. Take about hours from the time you get in to when you leave. After the. Whole blood is usually donated to a nonprofit organization. They only charge enough to meet cost. Plasma donation centers are for profit.

Make Your Own Business Cards At Home

Vistaprint, GotPrint, and MOO are just some of the most popular online printing choices. Alternatively, you can Google printing companies within your local area. However, fundamentally, business cards are simply pieces of card with business details on them, and that makes them one of the easiest products to personalize. Use the Adobe Express business card designer to create your own personalized business cards. Customize with trending fonts, backgrounds, and more. Create now. Business card design programs may be purchased from office supply retailers or found online, or you may use your current word processing program if it offers. Let The UPS Store help you design and print the perfect business card to represent your business. Pair your budget-friendly business cards with custom. Print professional and eye-catching business cards online with our custom printing services. Choose from various designs and cardstock options to create a. Create & print your custom business cards at Staples. Choose from a wide selection of card styles, and easily upload your own design. Those hoping to design business cards from scratch can utilize Canva to create custom business cards with an array of attractive templates. With a wide. Design and print custom business cards in Canva. Use pre-made templates and order prints on a variety of paper stocks, finishes, and shapes. Vistaprint, GotPrint, and MOO are just some of the most popular online printing choices. Alternatively, you can Google printing companies within your local area. However, fundamentally, business cards are simply pieces of card with business details on them, and that makes them one of the easiest products to personalize. Use the Adobe Express business card designer to create your own personalized business cards. Customize with trending fonts, backgrounds, and more. Create now. Business card design programs may be purchased from office supply retailers or found online, or you may use your current word processing program if it offers. Let The UPS Store help you design and print the perfect business card to represent your business. Pair your budget-friendly business cards with custom. Print professional and eye-catching business cards online with our custom printing services. Choose from various designs and cardstock options to create a. Create & print your custom business cards at Staples. Choose from a wide selection of card styles, and easily upload your own design. Those hoping to design business cards from scratch can utilize Canva to create custom business cards with an array of attractive templates. With a wide. Design and print custom business cards in Canva. Use pre-made templates and order prints on a variety of paper stocks, finishes, and shapes.

Make a lasting first impression. Create and print professionally designed custom business cards using Brother templates for a variety of businesses. Customize. Create a new document. Create a new document with the dimensions 2 inches by inches, which is the standard business card size in the United States. · Design. Want to create your own Business Card? If yes, then this is the app for you. Create your own business card in just few seconds, just enter your details and. Alternatively, we have a beginner-friendly online tool with several customization features to help you create a business card design from scratch – just click. I use a custom die-cut sticker product from Etsy. I send them an image file and they send back the photos within a few days! I like it as an. Need a business card? We've got you covered. Use our Business Card Maker to browse our free, customizable templates or create your own card from scratch. Create a professional business card with our online design tool. We have hundreds of print-ready templates in a variety of styles and layouts. Business card printing: create business cards online with VistaPrint. Print from thousands of designs to make custom business cards at an unbeatable price! Home; Business Cards. Business Cards. Affordable Custom Business Card Designs. Customize cheap business cards online to make your first impression a lasting one. Design your business cards online and print them with VistaPrint. 50 cards from $ We offer a variety of templates, premium papers and shapes to choose. 1. Try using a free online service like Canva that offers a wide variety of templates that you can use to create your business card design. You can design your own free printable business cards immediately - online! Our business card maker creates layouts with either 8 business cards per page or With Shutterfly, you can design your own personalized business cards online so they perfectly suit your style and represent your personal or professional brand. With MOO US, you can make standout Business Cards. Customise your Business Card design online, upload your own or use one of our templates. Visit us today! Make your own personalized business cards with our online business card maker. Easily edit text, change colors, and add a logo. Standard business card size is 3 1⁄2” x 2” · Printed on″ Thick 2ply Veneer · Printed inks are CMYK. Inks are not % opaque, and the wood coloring will show. Create your own unique business cards by using our online design tool. It's easy to use because you will be guided through each step of the design process. You can get great results with a desktop printer, too. Using a desktop printer gives you the flexibility to change your business cards at any time to better fit. Another unique feature is interactive elements. Customers can choose options like scratch-offs or pop-ups. These elements make business cards more engaging and.

Axis Bank Personal Lone

Axis Finance: A leading Non- Banking Financial Company (NBFC) in India, provides personal loans, home loans, business loans, & various financial services. Here is how you apply · Tap on Get now and you will be redirected to the Axis Bank login page. · Provide your Mobile Number and Date of Birth/PAN to start the. The online Personal Loan EMI calculator uses parameters such as loan amount, tenure and interest rate to calculate the EMI details for borrowers who have taken. You can get a personal loan up to Rs. 15 lakh from AXIS bank in case you meet with the below eligibility requirements. Calculate your personal loan EMIs with Moneyview's Axis Bank Loan EMI Calculator. Enter the loan amount, interest rate, and tenure to know your EMI within. FAQ for Axis Bank Personal Loan Eligibility · Applicant must be a salaried individual · Applicant Age should be between 21 - 60 years · Minimum Income should be. Get personal loans of up to Rs lakh at interest rates starting % p.a. with flexible repayment tenures of up to 7 years with Axis Bank. Get to know about Axis Bank Personal Loan interest rates along with eligibility criteria, documents required, and more information in detail. Apply for Axis Bank Personal loan with low interest rates starting at %. Easy process with same day disbursal. Avail a loan upto Rs. 9 lakhs with Airtel. Axis Finance: A leading Non- Banking Financial Company (NBFC) in India, provides personal loans, home loans, business loans, & various financial services. Here is how you apply · Tap on Get now and you will be redirected to the Axis Bank login page. · Provide your Mobile Number and Date of Birth/PAN to start the. The online Personal Loan EMI calculator uses parameters such as loan amount, tenure and interest rate to calculate the EMI details for borrowers who have taken. You can get a personal loan up to Rs. 15 lakh from AXIS bank in case you meet with the below eligibility requirements. Calculate your personal loan EMIs with Moneyview's Axis Bank Loan EMI Calculator. Enter the loan amount, interest rate, and tenure to know your EMI within. FAQ for Axis Bank Personal Loan Eligibility · Applicant must be a salaried individual · Applicant Age should be between 21 - 60 years · Minimum Income should be. Get personal loans of up to Rs lakh at interest rates starting % p.a. with flexible repayment tenures of up to 7 years with Axis Bank. Get to know about Axis Bank Personal Loan interest rates along with eligibility criteria, documents required, and more information in detail. Apply for Axis Bank Personal loan with low interest rates starting at %. Easy process with same day disbursal. Avail a loan upto Rs. 9 lakhs with Airtel.

Level 1: Front End Channels · Call Centre numbers: , · Email: [email protected] · Register Complaint for Axis Bank Personal. Axis Bank Personal Loans. Axis Bank Personal Loan offers faster personal loan sanctioning. You can avail a personal loan from Rs. to Rs. 40 lakhs with. Axis Bank Personal Loan eligibility criteria is set on the basis of the job profile, age, minimum monthly income, etc. of its personal loan applicants. The customers can simply contact the bank by calling on + for any assistance or for blocking the prepaid or debit cards anywhere anytime as the. How do I make overdue payments towards my loan? · Login to the Axis Mobile App · Select Loans · Click on Pay Overdue · Select Saving A/c (in case of multiple. Personal Loan Interest rates for salary accounts start from % p.a. onwards with tenure of years. The Minimum Monthly Salary for Axis Bank customers is. Axis Bank Personal Loan Customer Care Toll-Free Numbers - City-wise Customer Care Number, Email Address, Contact Details and Address in India. Axis Bank offers online facilities for all Personal Loan transactions with a user-friendly online banking platform and a mobile app. Axis bank offers the best interest rates and quick approval. The bank offers interest rates ranging from % to 21%. Apply for Personal loan up to ₹ 50 Lakh with a flexible loan tenure up to 7 years. Avail personal loans online with minimum documentation from Axis Finance. Avail 24x7 Personal Loans. Buy a car easily with pre-approved offers, up to % on-road funding! Apply now to get instant* funds without breaking your FD. Using the EMI Calculator · Identify your loan type: Select the appropriate calculator based on your desired loan (personal, car, bike, home or business). Get a personal loan from Axis Bank with fast approval and competitive interest rates. Fulfill your financial needs and achieve your goals. Apply online now! Apply for 24x7 Personal Loan and avail Instant Personal Loan with Instant Loan Approval, Life Insurance Cover and Attractive Interest Rates. 4 Steps to get a personal loan: Loan application and eligibility: Today, Reza can apply for a loan either online or offline. It is preferable to apply online. Any existing mandates will be automatically migrated to the new loan account. However, if you are making payments through NEFT from any other bank account. Salaried individuals can apply for the loan. Amount of loan to be given is minimum Rs. 50, and maximum is Rs. 15 lakhs. However, the actual loan amount to be. 7. Who is eligible to take Axis bank personal loan? · - A person with a minimum age of 23 years. · – A person with a maximum age of 60 years at loan maturity. Axis Bank Personal Loan Interest Rate starting at %. Know the latest interest rate of Axis Bank, fee and charges. Track Your Loan Here Please enter your mobile no. provided to the bank. SUBMIT.

Is Lendingtree A Good Mortgage Company

LendingTree is 20 out of 26 best companies in the category Bank on Trustpilot · LendingTree is out of best companies in the category Financial Consultant. They are a reputable company and one of the largest out there. I would not be concerned should you choose to apply with them for a loan. If I. They're gross. You will never get to "view" the rates. It's a bait-and-switch. They'll just pass your information on to other lenders, and you'll get calls. All that's required is completing a single online form, after which you're given multiple lenders and loan offers to choose from. On the other hand, LendingTree. NMLS membership requires mortgage lenders to obtain state licenses and follow regulatory practices within the state where it does business. Individuals who. aspx/COMPANY/ . Follow. . Posts. About · Photos · Videos Find your best mortgage rate in two minutes or less with LendingTree. We reviewed data collected from 35 lender reviews completed by the LendingTree editorial staff to determine the best mortgage lenders in each category chosen. You may be a few clicks away from one of the best online mortgage lenders, if you know what to look for. So if you're wondering “is LendingTree good at helping customers with loans?” the answer is an easy YES. But the Company is not here to simply give you a loan. LendingTree is 20 out of 26 best companies in the category Bank on Trustpilot · LendingTree is out of best companies in the category Financial Consultant. They are a reputable company and one of the largest out there. I would not be concerned should you choose to apply with them for a loan. If I. They're gross. You will never get to "view" the rates. It's a bait-and-switch. They'll just pass your information on to other lenders, and you'll get calls. All that's required is completing a single online form, after which you're given multiple lenders and loan offers to choose from. On the other hand, LendingTree. NMLS membership requires mortgage lenders to obtain state licenses and follow regulatory practices within the state where it does business. Individuals who. aspx/COMPANY/ . Follow. . Posts. About · Photos · Videos Find your best mortgage rate in two minutes or less with LendingTree. We reviewed data collected from 35 lender reviews completed by the LendingTree editorial staff to determine the best mortgage lenders in each category chosen. You may be a few clicks away from one of the best online mortgage lenders, if you know what to look for. So if you're wondering “is LendingTree good at helping customers with loans?” the answer is an easy YES. But the Company is not here to simply give you a loan.

I found the right mortgage lender using LendingTree. I will go to them in the future before I search for a company on my own. Perfect place to shop. We think the best endorsement comes from people who found a loan through LendingTree. We get letters and emails each day from happy borrowers who found a loan. No LendingTree is not a mortgage lender. They only collect your general information, which is too basic to provide accurate mortgage loan quotes and estimates. Home Refinance · Home Mortgage · Lending Tree is not a lender, but a third-party service pairing applicants with lenders · Borrower lending needs (home loan, auto. In all fairness, LendingTree has been able to survive for almost 20 years with a minimum of controversy. If you're looking for one-stop shopping for loans or. LendingTree has an employee rating of out of 5 stars, based on company reviews on Glassdoor which indicates that most employees have a good working. Customer reviews of LendingTree are mixed. The lending platform has a out of 5 rating on TrustPilot, with 81% of more than 13, reviewers. What interest rates and personal loan terms does Lending Tree offer? Lending Tree has lower than average interest rates for lenders reviewed on SuperMoney. What. Outstanding customer service and a very easy loan process. Able to customize loan and also great working with people that actually understand what you expect. In all fairness, LendingTree has been able to survive for almost 20 years with a minimum of controversy. If you're looking for one-stop shopping for loans or. LendingClub is a legitimate loan company that offers loans ranging from $1, to $40, It also offers flexible loan terms and APRs that don't currently go. The “best” mortgage lender is different for everyone. Whether you're buying or refinancing, you want a combination of low mortgage rates and great service. Our. Our goal is to match consumers with lenders in our network and for those lenders to provide competitive loan options for the airjordan4.sitegTree would not. Overall, LendingTree is an excellent solution for businesses looking to grow but prefer to have more flexible financing alternatives at their disposal. Loan. The company does not fund or service loans. Instead, it helps borrowers find and compare loan offers. The company is perhaps best known for its other services. Lending Tree is a top-rated online loan marketplace for financial borrowing needs, including mortgage loans. With Lending Tree, consumers can view different. Find auto loan lenders and compare them in one place. Learn more · Student Loans. Find student loan lenders and compare them in one place. Learn more. Mortgage. They are a reputable company and one of the largest out there. I would not be concerned should you choose to apply with them for a loan. If I. reviews of LENDINGTREE "This company needs to start screening their Mortgage Brokers good advice. Please do not use Lending Tree and partner Net.

Senior Financial Analyst Resumes

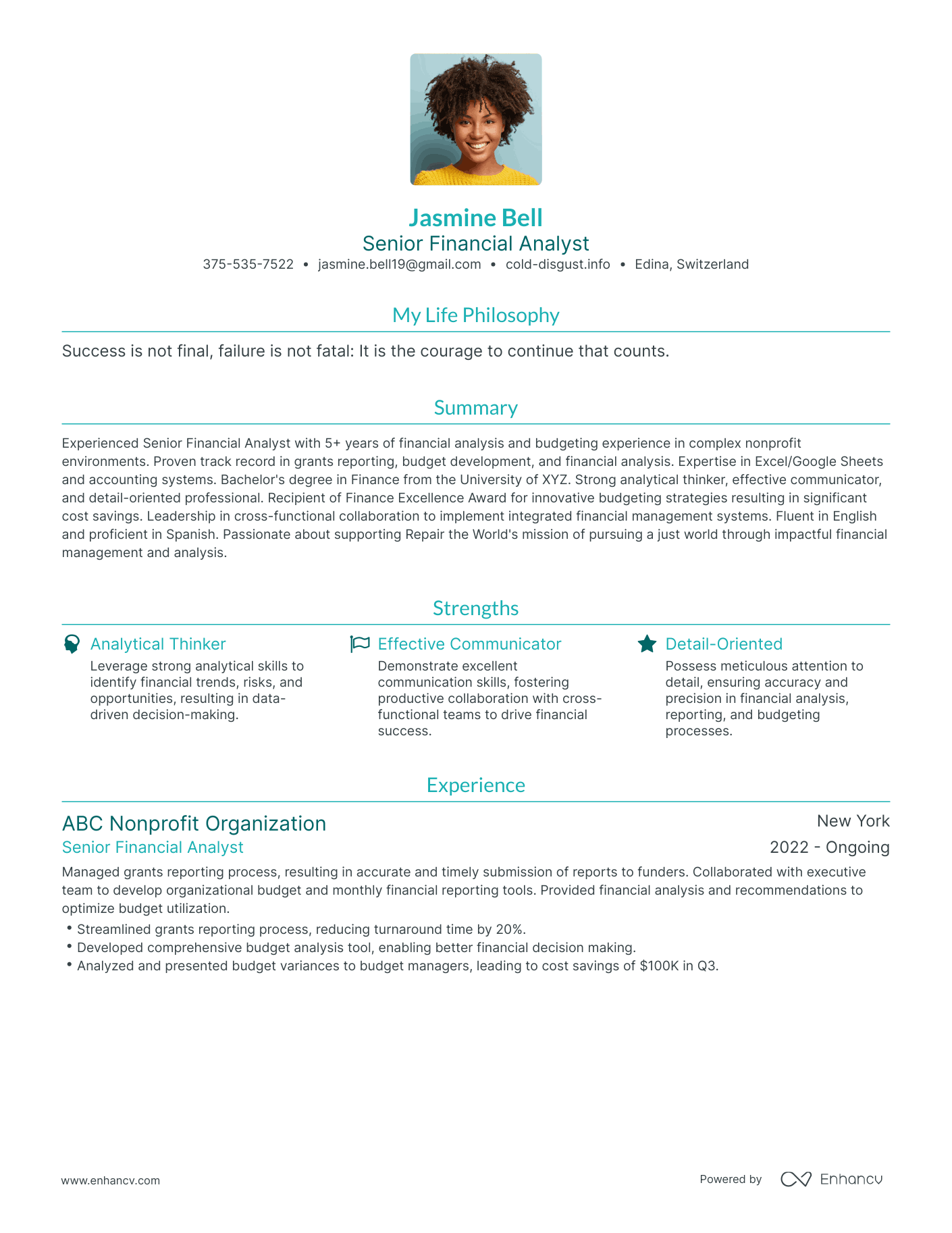

A Senior Financial Analyst Resume should make a display of a Bachelor's degree in finance, economics or Accounting. Top Financial Analyst Resume Skills · Managed a team of 50+ people. · Increased client revenue by 13% by improving client satisfaction scores. · Maximized accuracy. Find the best Senior Financial Analyst resume examples to help improve your resume. Each resume is hand-picked from our database of real resumes. QUALIFICATIONS SUMMARY. •. Detail-oriented Senior Financial Analyst with background leveraging CPA credentials and hands-on. Find and customize career-winning Senior Financial Analyst, Corporate resume samples and accelerate your job search. All senior financial analyst. To make your resume even stronger, work these skills into previous job bullet points, showcasing how you've used the skills in prior jobs. Also see: How To Say. Accurate and detailed airjordan4.siteial Analyst with planning, budgeting, forecasting, variance analysis and accounting expertise. Successful at managing multiple. Job-Winning Financial Analyst Resume Example · Follows the chronological resume format. · Lists contact information the right way. · Catches the recruiter's. To make your Senior Financial Analyst CV stand out, emphasize your analytical skills, proficiency in financial software, and experience in strategic planning. A Senior Financial Analyst Resume should make a display of a Bachelor's degree in finance, economics or Accounting. Top Financial Analyst Resume Skills · Managed a team of 50+ people. · Increased client revenue by 13% by improving client satisfaction scores. · Maximized accuracy. Find the best Senior Financial Analyst resume examples to help improve your resume. Each resume is hand-picked from our database of real resumes. QUALIFICATIONS SUMMARY. •. Detail-oriented Senior Financial Analyst with background leveraging CPA credentials and hands-on. Find and customize career-winning Senior Financial Analyst, Corporate resume samples and accelerate your job search. All senior financial analyst. To make your resume even stronger, work these skills into previous job bullet points, showcasing how you've used the skills in prior jobs. Also see: How To Say. Accurate and detailed airjordan4.siteial Analyst with planning, budgeting, forecasting, variance analysis and accounting expertise. Successful at managing multiple. Job-Winning Financial Analyst Resume Example · Follows the chronological resume format. · Lists contact information the right way. · Catches the recruiter's. To make your Senior Financial Analyst CV stand out, emphasize your analytical skills, proficiency in financial software, and experience in strategic planning.

Highly skilled in budgeting, forecasting, variance analysis and trend identification to optimize financial performance. Recognized for exceptional attention to. Experienced Senior Financial Analyst with 5+ years of financial analysis and budgeting experience in complex nonprofit environments. 18 votes, 22 comments. 34K subscribers in the FPandA community. A place to discuss all things about Financial Planning and Analysis (FP&A). Write a resume for any kind of financial analyst position by working from a job description, highlighting the right skills, and focusing on results—plus a. A recruiter-approved Senior Financial Analyst resume example in Google Docs and Word format, with insights from hiring managers in the industry. The top three keywords employers use in Finance Analyst job descriptions are Financial Analyst appearing in % of postings, Analysis %, and Forecasting. Top Senior Finance Analyst Resume Skills for · Financial analysis and reporting · Financial modeling and forecasting · Budgeting and variance analysis. senior financial analyst fp a resume example with 6+ years of experience · Manage three P&Ls of R1's primary customers. · Collaborate with my team in the annual. Financial Analyst Resume · Provide robust modeling and reporting to facilitate executive-level decision making. · Strong analytical skills; support operations. Use Rocket Resume's Senior Financial Analyst resume builder. Build your resume now with our simple recruiter-approved resumes & templates. CV tips for Senior Financial Analyst · Highlight your experience and accomplishments in the finance field. · Focus on keywords specific to financial analysis. Professional Financial Analyst who has significant experience with public and private corporate reporting needs. Adept at departmental and corporate. Here are some additional tips for writing your financial analyst resume: Use important resume keywords wherever possible. You'll find many keywords in the job. The traditionally used chronological resume format is recommended for most job seekers and is what recruiters prefer. It's the most straightforward way to. Create a resume in minutes with professional resume templates. Create a resume in minutes. Guadalupe Beer Thompson Forest, Boston, MA +1 () Senior financial analysts collaborate with CFOs and other members of the executive team to determine the company's overall investment strategy and policies. Financial Analyst resume should include strong financial planning, analytical problem solving, project management and financial reporting skills. Senior Financial Analyst Resume · Maintained standard cost system, and developed new costs. · Prepared monthly forecast and annual budgets. · Prepared monthly and. The most common important skills required by employers are Certified Public Accountant, Collaboration, MBA, Financial Planning, Economics, Analysis and. r accounting knowledge to understand how financial analysis translates to financial.